Requirements for accountants

Each category on the client page will have one or more requirements. A requirement is essentially a question the accountant needs answered to complete the tax return.

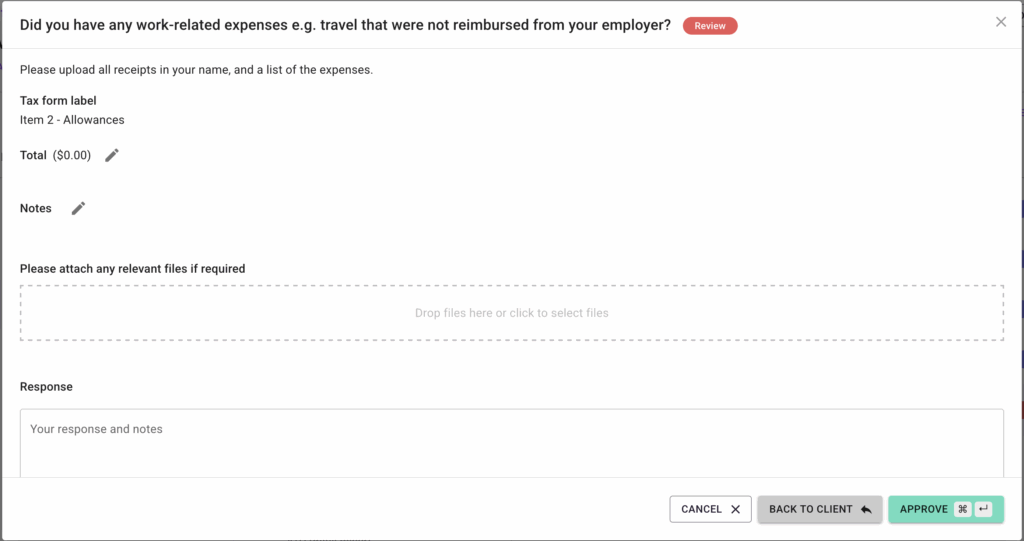

Click on a requirement to open the requirement window.

Each requirement has a title or question, and in some cases descriptive text.

Accountants also have “Notes” field where they can add text about the requirement that they need for reference. Clients cannot see the Notes text.

A requirement can also be set up with a total field – use this field to put in value which can then be consolidated when you download the working papers as an Excel file. In addition you can set up a requirement with a tax label – based on the fields from the ATO tax return.

Clients and accountants can upload files in the attachment – either by clicking on the attachment field or by dragging and dropping the file(s) from another window.

If needed, notes can added in the “Response” text field. When the client has finished their response they should click the “Return to Accountant” button. Clicking “Cancel” closes the window without change the status.

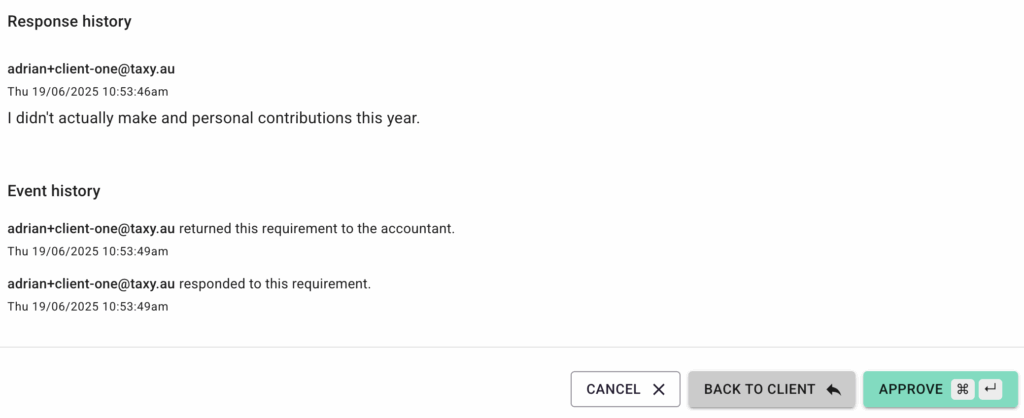

Responses are captured in the Response History section and can be used by accountants and clients to pose questions and answers. If a client asks a clarifying question, add a response and click the “Back to Client” button. The requirement will change status to “With client” and the next time the client opens taxy they will see they have a response from the accountant.

Once the accountant has reviewed the requirement and is satisfied they have everything they need, they click the “Approve” button, which will mark it as “Ready for (tax) return”. The client will no longer be able to add anything to the requirement.