Less chasing. More control.

Built for Australian tax workflows.

Replace checklists and email threads with one secure workflow that tracks progress in real time — so your team always knows what’s missing, what’s done, and what’s next.

MEET TAXY

Getting started is simple – we guide you through every step.

We’ll handle the setup so your workspace aligns with your existing workflows, not replaces them.

- Start by sharing with us how you currently collect and track client tax information.

- Send over any checklists or templates you already use and we’ll load them into the platform for you.

- You choose where to begin – most firms simply start with one multi-entity client group.

- Keep your existing workflow running in parallel until you’re comfortable. It'll naturally phase out.

Adopt Taxy your way, at your pace.

Map your current process

We start with a quick walkthrough of how your team currently collects, triages and tracks tax information.

We configure for you

Share any checklists or templates you use — we’ll replicate them so everything feels familiar.

Training from day one

We show your team how to use the platform with small, simple changes that slot into your existing workflow.

Start small, scale confidently

Begin with one multi-entity group to build confidence. Most firms expand fast once they see the difference.

Have questions? We’re here to help.

Whether it’s importing data, structuring templates, or troubleshooting something unexpected, our team’s always available to make sure you get the most out of Taxy.

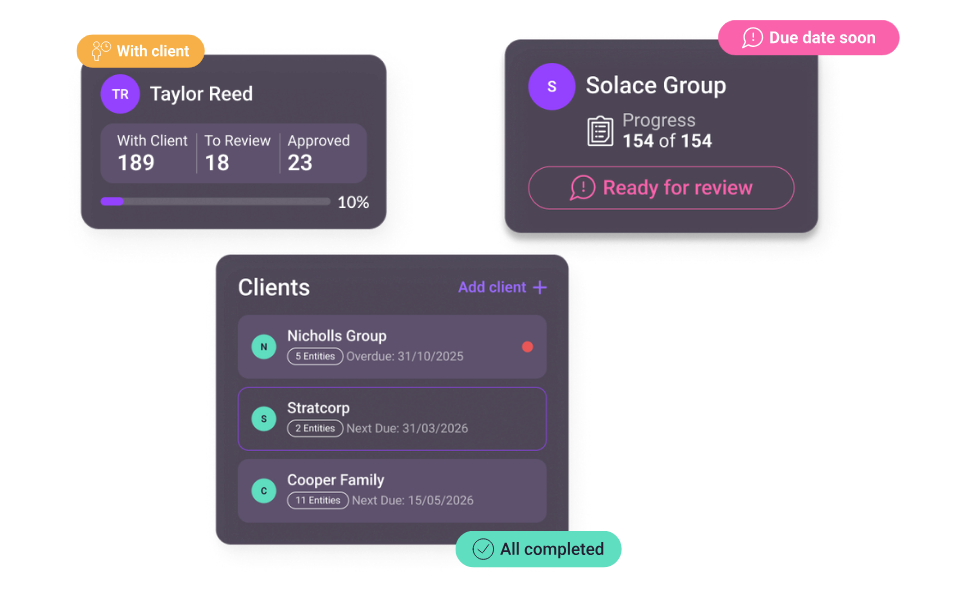

LIVE DASHBOARD

Know exactly where every return stands

- A bird's-eye view, in real time

- Status indicators for what's still outstanding

- Instantly spot what’s ready for review

- See at a glance how clients are progressing

No more guessing. No more chasing.

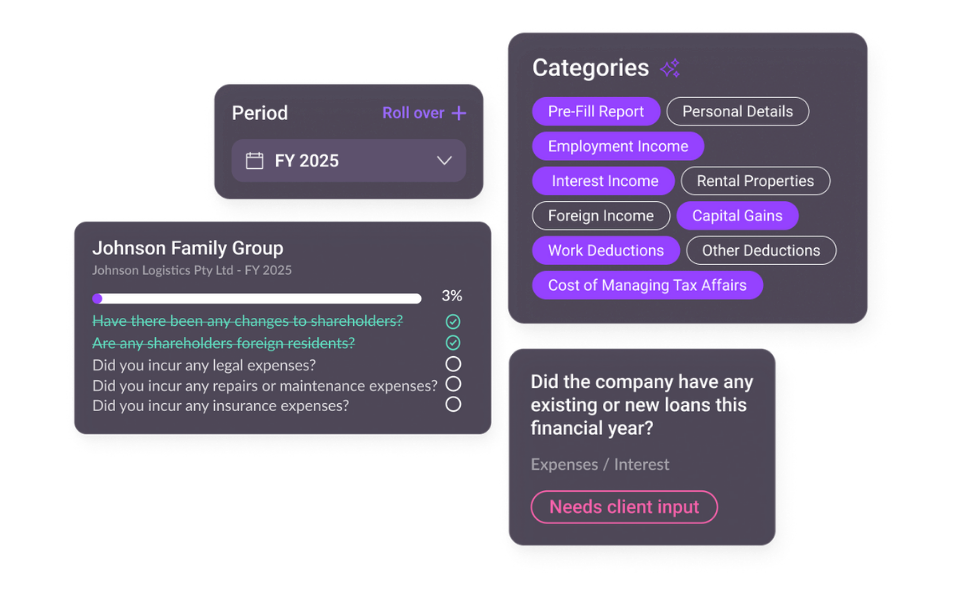

CUSTOM TEMPLATES

Set up once – reuse every year

- Requirements that fit how your firm works

- Consistent templates you can roll forward each year

- Less confusion when clients send what's needed first time

- Flexible edits without rebuilding from scratch

Customise for every client, without the extra work.

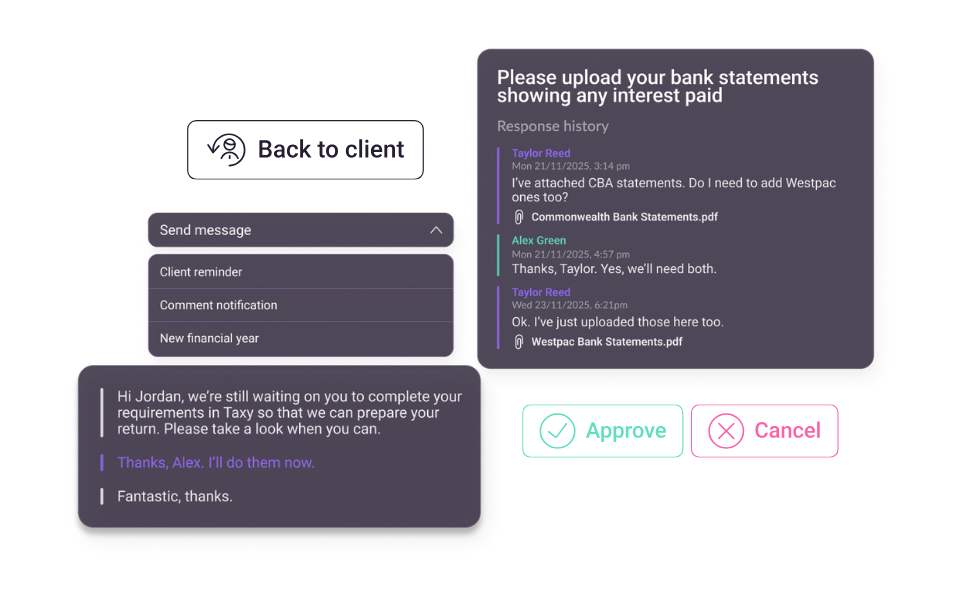

Connected Conversations

Every reply stays with the request it relates to

- Find what you need fast, without digging through your inbox

- Documents and responses stay linked to the exact requirement they belong to

- See conversations in context, not scattered across email threads

- Reduce confusion with a clear record of what was asked and provided

Clarity and control your inbox just can’t match.

Email wasn’t built for modern tax workflows.

See what is.

When you meet with us, it’s not just a demo.

We’ll show how firms like yours adopt Taxy within their existing workflows and start seeing value quickly—without a long and risky implementation project.

Frequently Asked Questions

These are the questions most firms we speak to have when deciding if Taxy is right for them.

Please get in touch if you have further questions.

How long does it take to get up and running?

Most firms are live within a few days.

Our team handles the setup, supports you with your initial clients, and stays close while you run your first few returns so the transition is low-risk.

Do we have to change what information we request?

No. Taxy is designed to sit around your current process.

We load your existing checklists and configure them inside the platform so they feel familiar from day one.

Can we start with one client or a proof of concept?

Yes — and we encourage it.

Most firms pick one client to run Taxy alongside their current process. Once they experience the increased visibility and reduced chasing, they gradually roll out from there.

What support will we receive?

You’ll have a dedicated contact for onboarding guidance, technical support, and ongoing optimisation support throughout the year — including peak times.

We’re here to make sure your team can keep work moving when it matters most.