Stop wasting time chasing tax clients for information.

Replace manual checklists and back-and-forth email chains with one secure workflow for faster document collection and real-time tracking.

THE PROBLEM

Client checklists and email threads slow you down, and leave you blind to where things stand.

Customising checklists at scale is difficult, so clients end up sending back too much or too little of what’s needed to lodge their return.

Sending requests for information over email means you have no visibility into how clients are progressing unless you ask them.

Responses come through over multiple emails, resulting in long email chains that make it difficult to locate specific replies at a later time.

THE SOLUTION

Taxy replaces them with one secure, structured workflow to speed up document collection and give you real-time visibility.

We help your team work through returns faster with less guessing and more peace of mind.

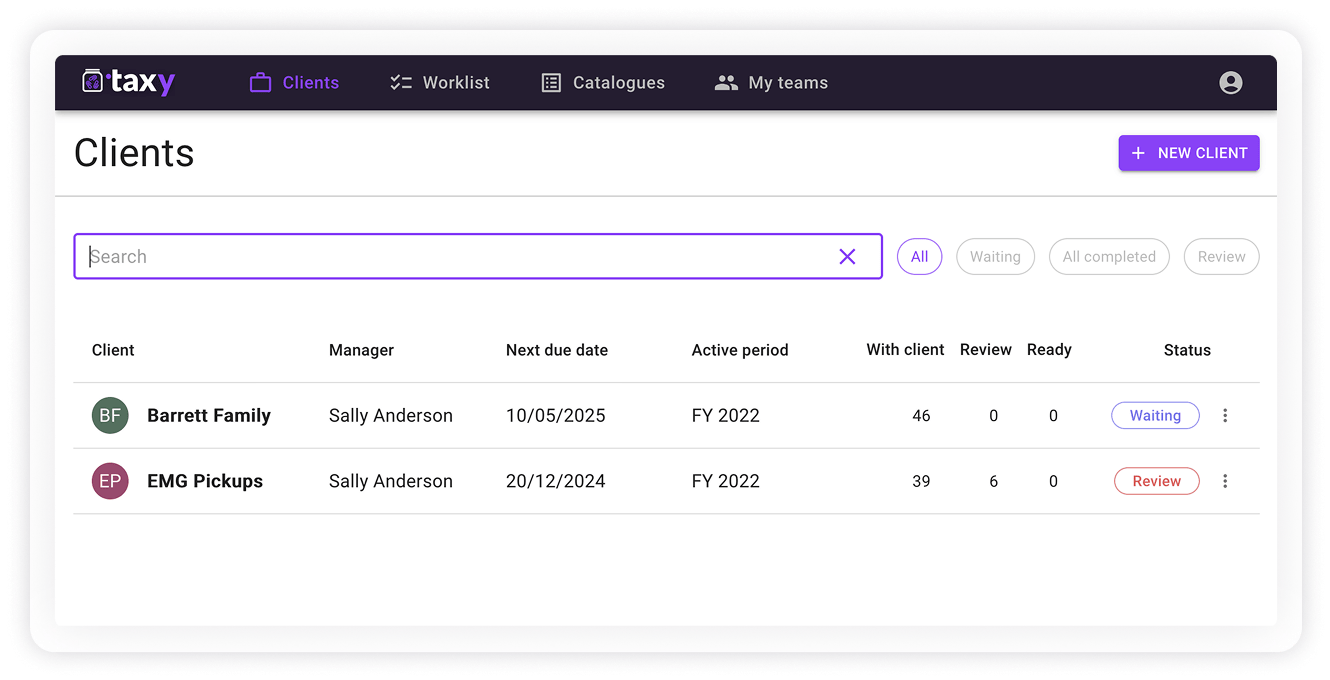

LIVE DASHBOARD

See at a glance what’s missing.

If you use manual checklists and emails, it takes time to figure out which clients have sent what, and what’s still outstanding.

Taxy gives you real-time visibility across every entity, so your team always knows what’s complete and what needs a follow-up.

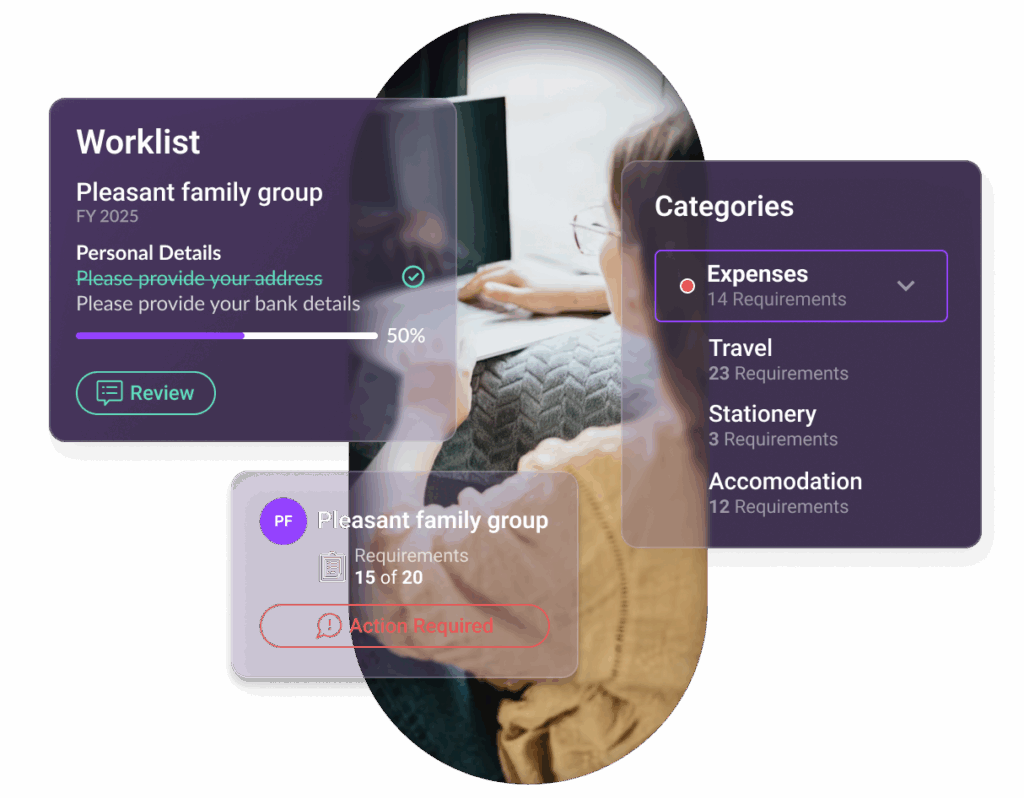

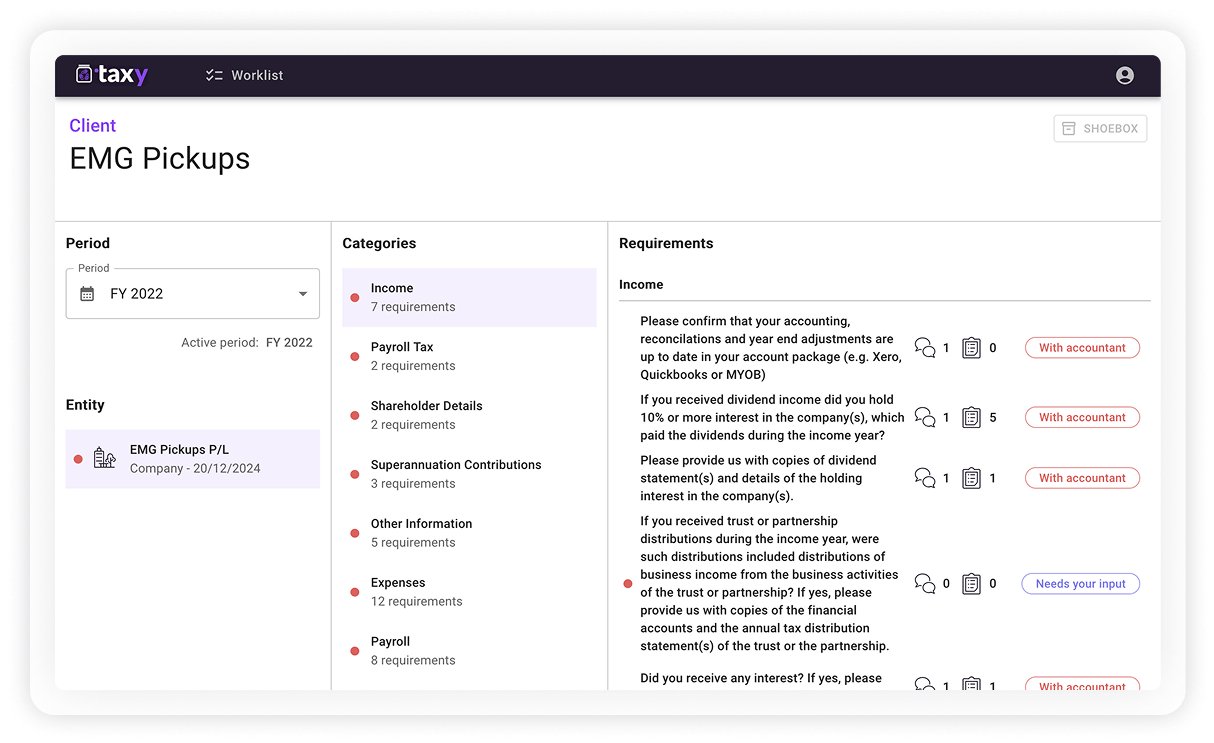

Custom Templates

Customise once. Reuse every year.

Generic checklists often lead to incomplete responses or clients sending irrelevant documents, which creates extra work for your team.

With Taxy, you can customise requirements per entity and roll them over each year to save time and help clients get it right the first time.

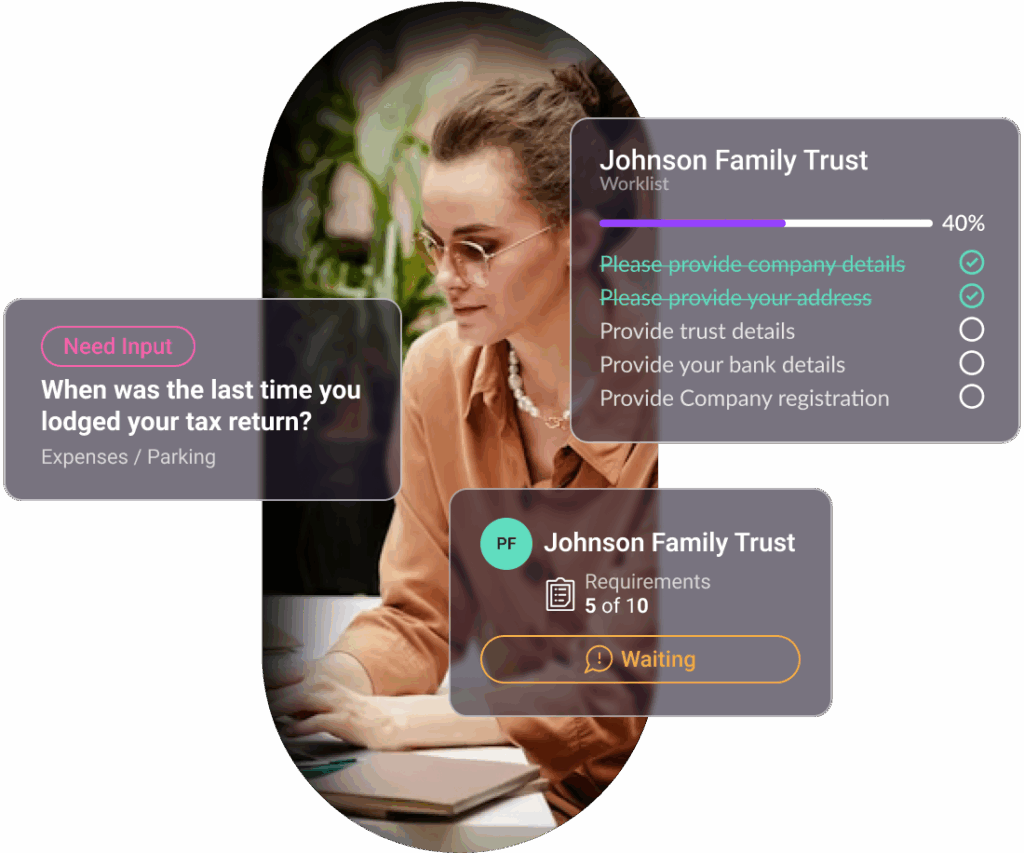

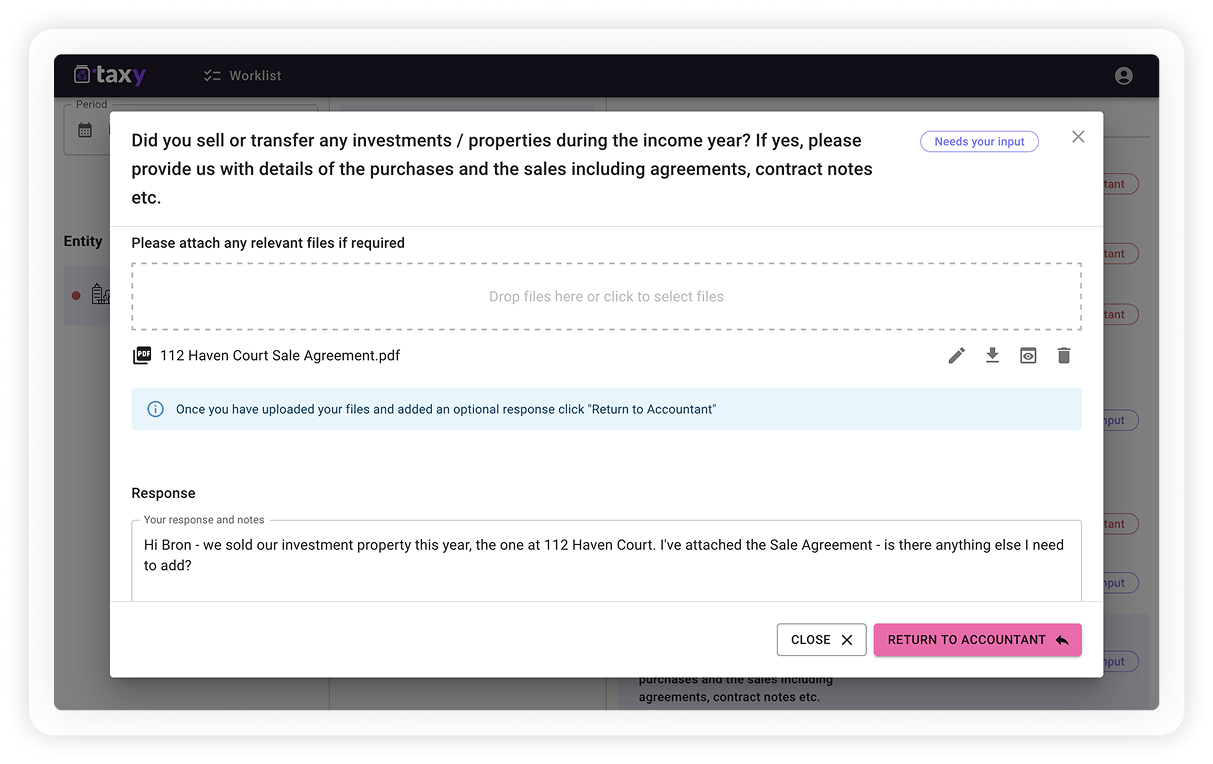

EASY COMMUNICATION

Take follow-ups out of your inbox.

Important replies and documents often get buried in long email threads, making them hard to find when you need them.

Send messages and follow-ups against specific requirements in Taxy, so every conversation stays linked, clear, and easy to access.

Hear how Taxy is loved by Accountants and Clients alike

Work through returns faster with less guessing and more peace of mind.