Use your current tax checklist in a smarter way

Every year you send your client a checklist of questions to answer. Maybe in a Word document, or a PDF. Perhaps they send it back via email, along with a bunch of attachments (but not all of them).

Not every question in your checklist applies to each client though, and during the course of completing it your clients will be wondering why you’re asking about things that clearly don’t apply to them.

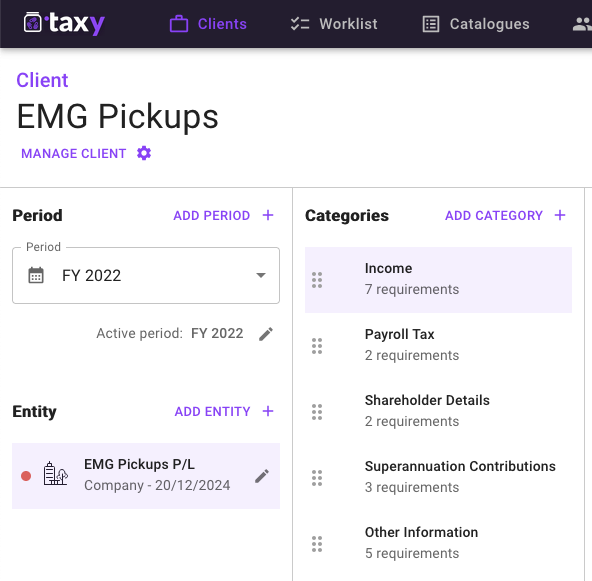

Upload your Individual, Company and Trust checklists into taxy once, and then you can modify it for each return, being sure to only ask the questions that you need to.

Eagle eye view

A common complaint we hear from accountants is it can be hard to know the status of a client query. Checking through the team to find out who knows the answer is tedious and a waste of time.

Checking if a document has been sent in by a client is simple – just look in taxy. Everything is in the one place, not hidden in another team member’s email, or stuck in a document management workflow.

No need to ask anyone. Get the answer to your query immediately.

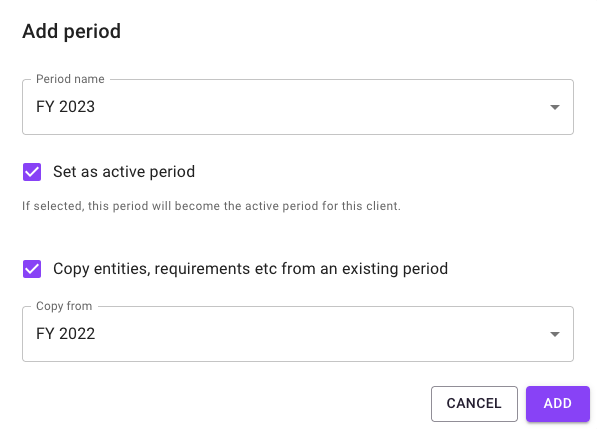

Easy client setup each year

taxy makes it easy to get your clients ready for the new financial year. The rollover feature allows you to maintain the same categories and questions for each client and their taxable entities from year to year.

Documents that have a longer shelf-life than one year can be marked as permanent and carried forward into the same place each year for easy reference.

Once setup for the new year is done you can easily send a note to your clients from within taxy.

Secure storage for client data

All client data stored in taxy is subject to the highest standards of encryption and security.

All stored data is encrypted, and all data is encrypted in transit.

We require two-factor authorisation for accountants and offer it as an option for their clients.

Our cloud services partner uses the highest-grade encryption in the world and has multiple layers of authorisation and security.